What is the Forex Market?

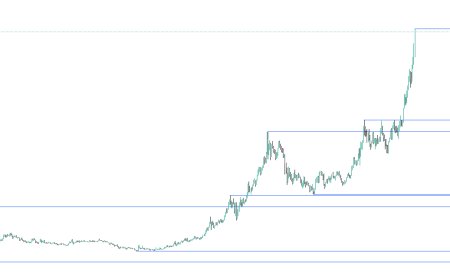

In the Forex Market, traders buy/sell by estimating the relative value of different pairs.

What is the Forex Market?

The Forex Market is an international market for buying/selling currencies. Where currencies of different countries are bought and sold against each other. The Forex Market is not limited to currencies only. Forex, cash CFDs, metals, crypto, exotics, equities, agricultural commodities, and various cash indices are traded in this market.

In the Forex Market, traders buy/sell by estimating the relative value of different pairs.

Features of the Forex Market:

The Forex Market is the largest financial liquid market in the world. The average daily volume of this market is more than 7.5 trillion US dollars.

We know that the New York Stock Exchange is the largest stock market in the world. Its average daily transaction is about 22.4 billion US dollars. So, think about how big the Forex Market is.

The Forex Market does not have a specific central or center. This is why the Forex market is called an over-the-counter (OTC) market. There are no intermediaries in the Forex market. There are direct transactions between the two parties.

In addition, there are some other special features of the Forex market. For example,

1. The Forex market is decentralized worldwide, with no specific center. The Forex market is open twenty-four hours a day, five days a week, without any intervention. Now you may ask, how is this possible? In fact, the market has some trading zones.

For example,

First, if we start the market from Auckland/Wellington, then it starts in Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and finally in New York, then trading starts again in New Zealand! In this way, the market is open twenty-four hours a day. Again, when the market is closed on Saturday and Sunday, the market is closed all over the world.

2. The Forex market has the highest amount of liquidity in the world. In addition, the Forex market is the largest financial market in the world. Where trillions of dollars are traded every day.

3. In this market, currencies of different countries can be traded in pairs. Such as EUR/USD, GBP/USD, USD/JPY, etc.

4. Traders speculate in this market to profit from currency price changes. Traders imagine how much one currency will increase or decrease in price against another currency for a certain period. Based on which traders buy/sell.

5. Another special feature of this market is that when a deal or agreement is made between a buyer and a seller, it can be closed at any time. There is no time limit for this. (This applies to the retail forex market.)

Who trades in the forex market?

As a trader, you must know who mainly works in the forex market. If the common man participates in this market, he is called a retail trader. There is a hierarchy among traders in this market.

For example, retail traders, central banks, commercial banks, corporations, hedge funds, institutes, etc.

I hope that through this article, you have gained a good idea about the Forex market. Maybe you are interested in knowing more. Don't worry. We will continue to provide you with a series of articles. Thank you.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0